Insurance

| Life Insurance | VS | Mortgage Insurance |

|---|---|---|

| You own and control the policy | OWNERSHIP | The bank owns the policy |

| Coverage will never decrease and can protect more than just your home | AMOUNT OF COVERAGE | As your mortgage decreases so does the coverage |

| Payments are guaranteed to remain the same for the term of your policy | PAYMENT | Payments remain the same for the term of your mortgage only |

| Re-financing your mortgage has no impact on your life insurance policy. | INSURANCE PORTABILITY | Re-financing your mortgage may terminate your coverage. |

| You can use your insurance for a different purpose altogether. | FLEXIBILITY | Insurance is used for mortgage protection only. |

| Regardless of your health, the policy can be converted from term to whole life without a medical evaluation. | CONVERTIBILITY | Not convertible. |

| You choose your beneficiary. Upon death, your beneficiary receives the proceeds. | BENEFICIARY | The bank is the beneficiary and the death benefit is used to pay off the mortgage only. |

| You work with a financial services professional who is a licensed life insurance advisor, trained to understand your holistic financial needs. | SALES CREDENTIALS | You work with a financial services professional who may no be licensed to sell life insurance, which can be an important part of a comprehensive financial plan. |

Request An Insurance Quote

Disability Insurance

Critical Illness Insurance

Term Insurance

Permanent Insurance

Just 4 Simple Questions

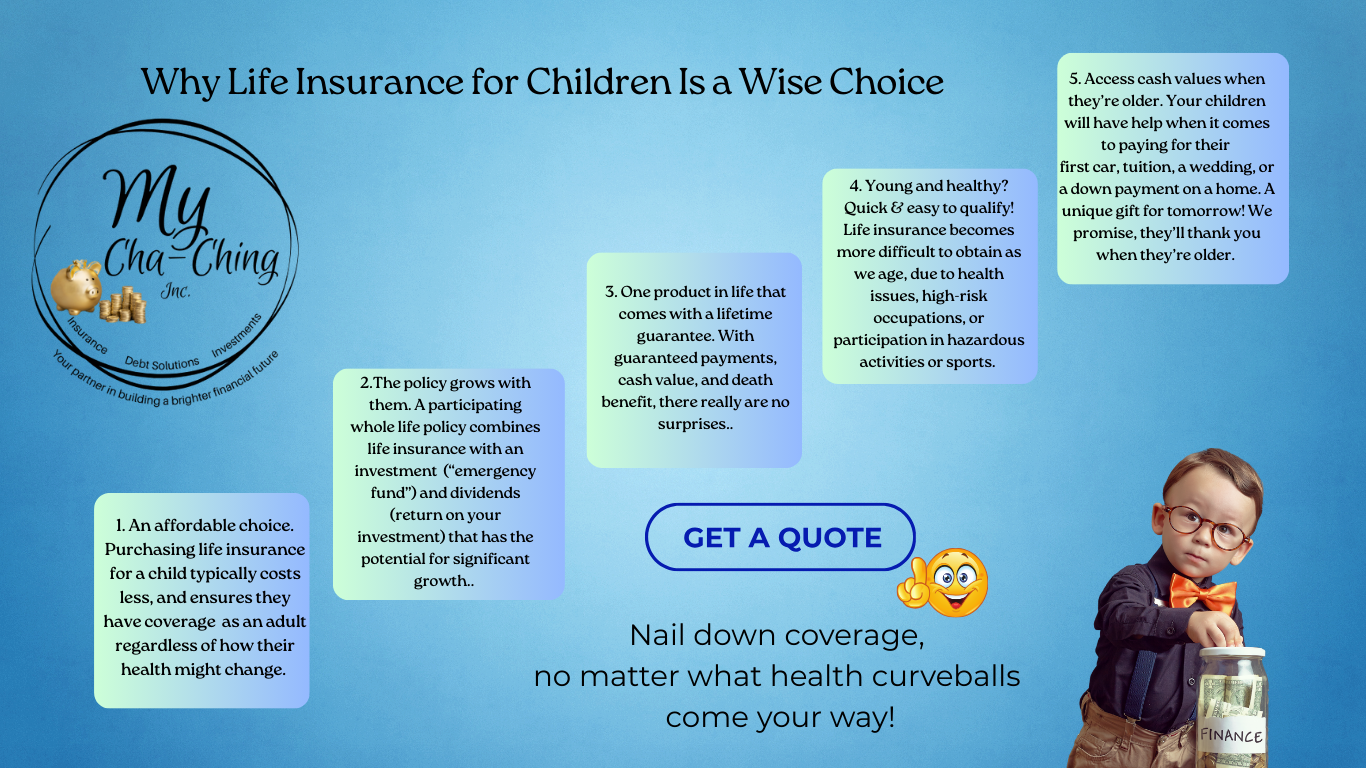

Nail down coverage, no matter what health curveballs come your way!